Acord Cancellation Form

Are you in the process of canceling an insurance policy and need guidance on how to properly complete an Acord Cancellation Form? Look no further! In this blog post, we will provide you with a comprehensive guide on why you need an Acord Cancellation Form and the importance of providing accurate information. We will also walk you through a step-by-step process of filling out the form, as well as highlight common mistakes to avoid. Additionally, we will discuss what to expect after submitting the form, ensuring that you have a clear understanding of the entire process. By the end of this post, you will have all the necessary information to confidently and accurately complete an Acord Cancellation Form. So, let’s dive in and make the cancellation process as smooth as possible!

Acord Cancellation Form Download

Why You Need an Acord Cancellation Form

When it comes to insurance, accuracy is key. An Acord Cancellation Form is a crucial document that allows you to cancel your insurance policy. Whether you’ve found a better deal elsewhere or simply no longer need the coverage, it’s important to follow the proper procedures when canceling your policy. Failing to do so could result in penalties or fees, and could even impact your ability to obtain future coverage.

One of the main reasons why you need an Acord Cancellation Form is to protect yourself from any liabilities that may arise after canceling your policy. Without a formal cancellation, you could still be held responsible for any claims that arise after the date of cancellation. By properly completing and submitting the form, you can ensure that your policy is effectively terminated, protecting you from any unforeseen consequences.

Additionally, having a record of your cancellation can be useful for future reference. If you ever need to prove that you cancelled a policy on a specific date, having a completed Acord Cancellation Form can serve as evidence of the cancellation. This can be particularly important if there are any disputes or discrepancies regarding the cancellation of your policy.

Ultimately, having an Acord Cancellation Form on hand is essential for anyone who holds an insurance policy. It not only protects you from potential liabilities, but also ensures that you have a formal record of your cancellation for future reference. By understanding the importance of this document and the reasons why you need it, you can navigate the cancellation process with confidence and peace of mind.

Understanding the Importance of Accurate Information

Accurate information is crucial in all aspects of life, including insurance. When filling out forms such as an Acord Cancellation Form, it is important to ensure that all the information provided is true and up to date.

Having accurate information on the form ensures that the cancellation request is processed smoothly and without any hiccups. Inaccurate information could result in delays or even rejection of the cancellation request, causing inconvenience to the policyholder.

Insurance companies rely on the information provided by the policyholder to assess risk and determine premiums. Inaccurate information could lead to incorrect risk assessment, potentially resulting in a policy that does not adequately cover the insured in the event of a claim.

It is also important to note that providing inaccurate information on insurance forms is considered as misrepresentation, which could have legal and financial implications. Therefore, it is essential to take the time to ensure that all information provided is accurate and truthful.

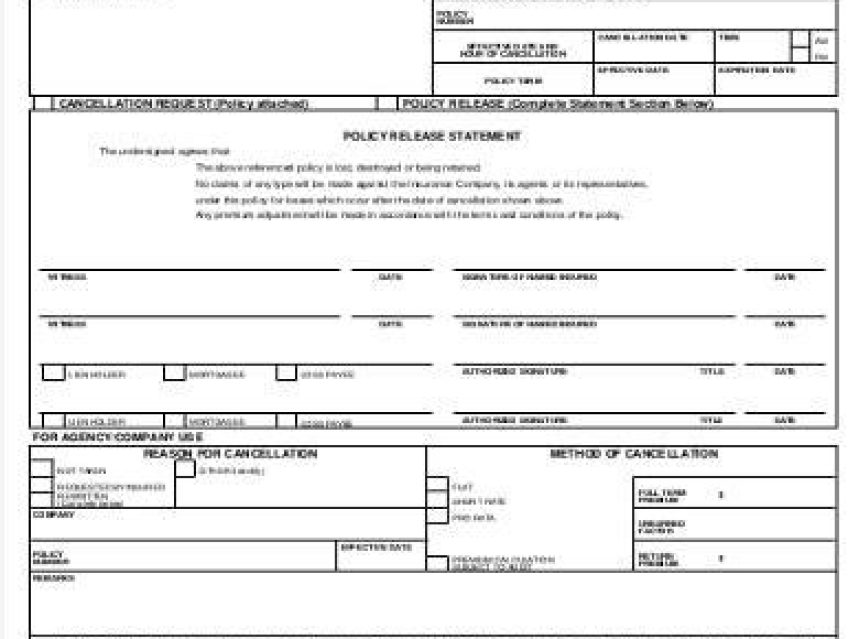

Step-by-Step Guide to Filling out an Acord Cancellation Form

When it comes to filling out an Acord Cancellation Form, it’s important to ensure that you provide accurate and complete information. This form is used to officially cancel an insurance policy, so any errors or omissions could lead to issues down the line.

First, start by filling out the basic information section. This includes details such as the insured’s name, policy number, effective date of the cancellation, and the reason for cancellation. It’s crucial to double-check this information to avoid any discrepancies.

Next, you’ll need to provide information about the policy that is being cancelled. This includes the type of insurance, the coverage period, and any premium refund due. Make sure to accurately input these details to avoid any payment or coverage discrepancies.

Once the form is filled out, it’s important to review it for any errors or missing information. Taking the time to thoroughly review the form can help prevent delays in the cancellation process. Once you’re confident that all the information is accurate, sign and date the form before submitting it to your insurance provider.

Common Mistakes to Avoid When Completing the Form

When completing an Acord Cancellation Form, it’s important to be diligent and thorough to avoid any mistakes that could lead to delays or complications. One common mistake to avoid is providing inaccurate information. Whether it’s a misspelled name, incorrect policy number, or wrong effective date, any discrepancies can cause issues with the processing of the form. It’s crucial to double-check all the details before submitting the form to ensure everything is accurate and up to date.

Another mistake to avoid is leaving any mandatory fields blank. The Acord Cancellation Form contains essential information that must be filled out completely. Failure to do so can result in the form being rejected or sent back for completion, causing unnecessary delays in the cancellation process. Make sure to review the form thoroughly and ensure that all required fields are properly filled out to avoid any complications.

Additionally, one common mistake is not providing the necessary documentation to support the cancellation request. Depending on the reason for cancellation, certain documents may be required to process the request. Failure to include these documents can lead to delays or even denial of the cancellation. It’s important to review the requirements for cancellation and ensure that all necessary documentation is provided along with the form.

Lastly, a common mistake to avoid is not following the correct submission process. Submitting the Acord Cancellation Form through the wrong channel or to the wrong recipient can result in delays or issues with the processing of the request. It’s essential to follow the specified submission process outlined by the insurance provider to ensure that the form is received and processed in a timely manner.

What to Expect After Submitting an Acord Cancellation Form

Once you have submitted an Acord Cancellation Form, you can expect the process to take a few days to a few weeks, depending on the insurance company and the complexity of your request. After submitting the form, the insurance company will review the information and verify the details provided. This may involve contacting you for any additional information or documentation that is required to process the cancellation.

After the review process is complete, the insurance company will issue a final cancellation notice confirming the termination of your policy. This notice will outline the effective date of cancellation and any refunds or outstanding balances that need to be addressed. It is important to carefully review this notice to ensure that all the details are correct and to follow up with the insurance company if you have any questions or concerns.

Following the cancellation, you can expect any refunds owed to be processed and issued to you. This may take a few additional weeks to be completed, as the insurance company will need to calculate any pro-rated premiums and process the refund accordingly. It is important to keep an eye on your bank account or mail for the refund to ensure that it is received in a timely manner.

Finally, after the cancellation process is complete, you should receive a confirmation letter or email from the insurance company, acknowledging the termination of your policy and confirming that no further action is required from your end. It is important to keep this confirmation for your records and to follow up with the insurance company if you do not receive it within a reasonable timeframe.

Frequently Asked Questions

What is an Acord Cancellation Form?

An Acord Cancellation Form is a document used to request the cancellation of an insurance policy. It provides information about the policyholder, the policy being cancelled, and the effective date of cancellation.

Why do I need an Acord Cancellation Form?

You need an Acord Cancellation Form to officially request the cancellation of your insurance policy. It serves as a written record of your request and ensures that the cancellation process is properly documented.

How important is it to provide accurate information on an Acord Cancellation Form?

It is crucial to provide accurate information on an Acord Cancellation Form to avoid any potential issues with the cancellation process. Inaccurate information could lead to delays or complications in cancelling the policy.

Can you provide a step-by-step guide to filling out an Acord Cancellation Form?

Certainly! The step-by-step guide to filling out an Acord Cancellation Form typically includes providing your name and contact information, policy details, effective date of cancellation, reason for cancellation, and signature.

What are some common mistakes to avoid when completing an Acord Cancellation Form?

Common mistakes to avoid include providing incorrect policy information, not clearly stating the reason for cancellation, and forgetting to sign the form. It’s important to review the form carefully before submission.

What should I expect after submitting an Acord Cancellation Form?

After submitting an Acord Cancellation Form, you can expect the insurance company to process your request and confirm the cancellation of the policy. You may also receive a refund for any unearned premium.