Understanding Form 7203 and Its Importance for Tax Compliance

Understanding tax forms and their importance for compliance is crucial for individuals and businesses alike. One such form, Form 7203, plays a significant role in ensuring tax obligations are met. In this blog post, we will delve into the details of Form 7203, its importance for tax compliance, and provide tips for efficiently managing it. We will discuss what Form 7203 is, why it is important for tax compliance, how to accurately complete it, as well as the consequences of non-compliance. By the end of this post, you will have a clearer understanding of Form 7203 and be better equipped to fulfill your tax-related obligations. Whether you are an individual taxpayer or a business owner, grasp the significance of Form 7203 in staying compliant with tax regulations.

What is Form 7203?

Form 7203 is a document used by taxpayers to report and pay their federal excise taxes. These taxes are imposed on specific goods and services, such as gasoline, alcohol, and tobacco products. The form provides a way for businesses to comply with their tax obligations and ensure that they are contributing to government revenue.

Completing Form 7203 requires taxpayers to provide details about the excise taxes they owe, including the type and amount of goods or services sold. It also involves calculating the total tax liability and remitting the payment to the Internal Revenue Service (IRS).

Overall, form serves as a vital tool for monitoring and regulating excise tax payments. By accurately completing this form, taxpayers can demonstrate their commitment to tax compliance and avoid potential penalties for non-compliance.

Understanding the purpose and requirements of Form 7203 is essential for businesses that are subject to excise taxes. It ensures that they fulfill their tax obligations in a timely and accurate manner, thereby contributing to the smooth operation of the overall tax system.

Why is Form 7203 important for tax compliance?

Form 7203 is an essential document for taxpayers as it helps them comply with their tax obligations. This form is important for tax compliance because it provides the IRS with accurate and detailed information about an individual’s income, expenses, and deductions.

By completing form accurately, taxpayers can ensure that they are reporting their financial information correctly and avoiding potential penalties for non-compliance.

In addition, plays a crucial role in ensuring that taxpayers pay the correct amount of tax. By providing a comprehensive overview of their financial situation, individuals can use this form to calculate their tax liability accurately. This helps prevent underpayment or overpayment of taxes, which can lead to financial repercussions and legal consequences.

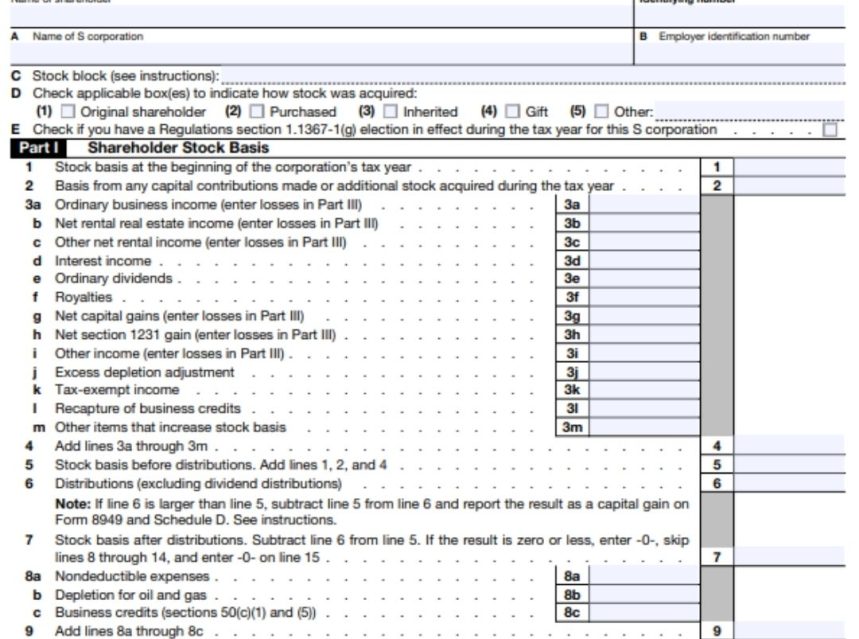

How to complete Form 7203 accurately?

Completing form accurately is crucial for ensuring compliance with tax regulations and avoiding potential penalties. One of the key steps to accurately completing form is to carefully review all instructions provided by the Internal Revenue Service (IRS). These instructions offer detailed guidance on each section of the form, including information on how to accurately report income, deductions, and credits. It’s important to take the time to read and understand these instructions before filling out the form.

Additionally, it’s essential to gather all necessary documentation before starting to complete Form 7203. This might include documents such as W-2s, 1099s, and receipts for deductible expenses. Having all of the required paperwork on hand can help ensure that accurate and complete information is included on the form.

It’s also important to double-check all entries for accuracy. This includes verifying that all amounts are reported correctly and that calculations are accurate. Mistakes or discrepancies on the form could lead to delays in processing or potential audits by the IRS.

Finally, seeking professional assistance from a tax advisor or accountant can be beneficial when completing Form 7203. Tax professionals have the knowledge and experience to help ensure that the form is completed accurately and in compliance with current tax laws. They can also provide valuable insights on potential deductions or credits that could help minimize tax liability.

Consequences of non-compliance

Non-compliance with Form 7203 can have serious repercussions for individuals and businesses. Failure to accurately complete and submit this form can result in hefty fines, penalties, and even legal action. The IRS takes tax compliance very seriously and any deviation from the rules and regulations can lead to severe consequences.

One of the major consequences of non-compliance with is the imposition of penalties. This can include both civil and criminal penalties, depending on the severity of the violation. The fines can range from a few hundred dollars to thousands of dollars, significantly impacting the financial health of the non-compliant party.

In addition to financial penalties, non-compliance with can also lead to legal action. The IRS has the authority to pursue legal measures against individuals or businesses that fail to fulfill their tax obligations. This can result in court appearances, legal fees, and a tarnished reputation.

Furthermore, non-compliance with Form 7203 can also have long-term implications on an individual or business. It can lead to audits, increased scrutiny from the IRS, and a heightened risk of future non-compliance. This can create a cycle of penalties and legal troubles that can be difficult to break free from.

Tips for timely submission of Form 7203

Ensuring the timely submission of Form is essential for S corporation shareholders who must report their stock and debt on this form as part of their individual tax returns. Procrastination can lead to unnecessary stress and errors, so it’s crucial to begin the preparation process well before the deadline. Gathering all pertinent financial statements, such as stock basis calculations, loan agreements, and repayments, can significantly streamline the process and help prevent delays in filing your tax return.

To avoid penalties associated with late filings, it’s advisable to mark critical deadlines on your calendar and set reminders. Creating a checklist of all the required documentation and information needed to complete Form 7203 will also help in tracking your progress and ensure nothing is overlooked. It’s beneficial to be aware of any updates or changes issued by the IRS related to the form that may affect the filing process or the information required with each tax year.

Frequently Asked Questions

Why is Form 7203 important for tax compliance?

Form 7203 is important for tax compliance because it ensures that businesses in certain industries fulfill their obligations to report and pay excise taxes. Filing this form accurately and on time is crucial for avoiding penalties and maintaining good standing with the IRS.

What happens if a shareholder fails to file Form 7203?

Failing to file Form 7203 can result in the IRS disallowing the deduction of losses and credits reported on the shareholder’s tax return. In some cases, penalties and interest may also be assessed on any tax underpayment that results from not properly filing the form.

Is it necessary to file IRS Form 7203 every year?

Yes, shareholders of an S corporation must file IRS Form 7203 annually with their personal tax return if they have stock or debt in the corporation and need to report their share of income, losses, deductions, or credits.