Form 3115 Instructions,Due Date

Are you a business owner looking to make a change in your accounting method? Form 3115, also known as the Application for Change in Accounting Method, is a crucial document that you may need to file with the IRS. Understanding the instructions, due date, automatic change list, and filing procedures for Form 3115 is essential for ensuring compliance with tax regulations. In this blog post, we will guide you through the key aspects of Form 3115, providing you with the information you need to successfully navigate this important tax document. Whether you’re a small business owner or a seasoned accountant, this post will help demystify the process of filing Form 3115.

Form 3115 Instructions

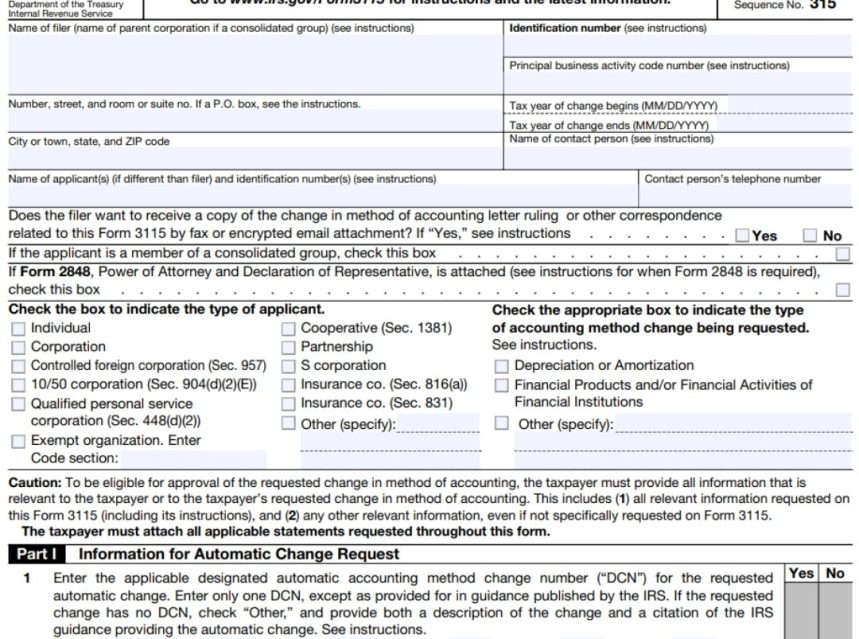

Application for Change in Accounting Method, is a form used by taxpayers to request a change in their accounting method for federal tax purposes. This form is necessary when a taxpayer wants to adopt a new accounting method, correct an error in their current accounting method, or make a late election for a previously missed opportunity.

Who needs to file Form 3115?

Any taxpayer, whether an individual, partnership, corporation, or trust, who wants to change their accounting method must file Form 3115. However, there are certain exceptions for small businesses with average annual gross receipts of $1 million or less for the three preceding tax years.

What information should be provided on Form 3115?

When filling out form, there are several key pieces of information that taxpayers need to provide. This includes their name, address, taxpayer identification number, fiscal year end, and a detailed explanation of the requested accounting method change. Additionally, taxpayers may need to attach supporting documentation, such as a statement of the effects of the accounting method change on their income and deductions.

What is the due date for filing Form 3115?

The due date for filing Form 3115 depends on the taxpayer’s filing status. For calendar year taxpayers, the form should generally be filed with their tax return by the due date of the return, including extensions. It’s important to note that filing Form 3115 late without reasonable cause may result in penalties, so it’s crucial to meet the applicable deadline.

Are there any special filing instructions for Form 3115?

Form 3115 can be complex, and it’s crucial to follow the specific instructions provided by the IRS. Taxpayers should carefully review the instructions for Form 3115, which can be found on the IRS website. It’s recommended to seek professional tax advice or consult a qualified tax professional for assistance in completing and filing form

In conclusion

Filing Form 3115 is an important process for taxpayers who wish to change their accounting method for federal tax purposes. By providing the necessary information and following the specific instructions, taxpayers can request a change in their accounting method and ensure compliance with IRS regulations. Remember to meet the applicable due date and seek professional assistance if needed to accurately complete and file Form 3115.

Form 3115 Due Date

When it comes to filing taxes, it is essential to understand the due dates for different forms and documentsAlso known as the Application for Change in Accounting Method, has its own specified due date. This form is used by taxpayers who want to request permission from the Internal Revenue Service (IRS) to change their accounting method. It is important to file this form accurately and on time to avoid any penalties or legal complications.

According to the IRS guidelines, the due date for Form 3115 depends on the taxpayer’s filing status and the type of return being filed. For individual taxpayers, the due date is usually April 15th or the 15th day of the fourth month following the end of the tax year. However, it is essential to check the specific due date for the tax year in question, as it may vary based on certain circumstances or extensions.

Additionally, it is crucial to note that the due date for Form 3115 may also differ for corporate taxpayers. Corporations generally have different tax return due dates, and therefore, the due date for Form 3115 may align with their specific corporate filing due date. It is recommended to consult the IRS guidelines or seek professional advice to ensure compliance.

- Key points to remember:

- Form 3115 is the Application for Change in Accounting Method.

- Filing this form accurately and on time is crucial to avoid penalties.

- Due dates for Form 3115 may vary based on filing status and tax year.

- Corporate taxpayers may have different due dates.

- Double-check the specific due date for the tax year in question.

In summary, the due date for Form 3115 is an essential aspect of tax compliance. Taxpayers should be aware of the specific due dates based on their filing status, tax year, and corporate taxpayer status. Filing this form accurately and on time is crucial to avoid any penalties or legal consequences. It is always recommended to consult the IRS guidelines or seek professional advice to ensure accurate and timely filing of Form 3115.

Summary of Important Dates for Form 3115

Filing Status Due Date

Individual April 15th or 15th day of the fourth month following the end of the tax year Corporation Depends on the specific due date for corporate tax returns

Form 3115 Automatic Change List

Form 3115 Automatic Change List is a valuable resource for taxpayers who need to make automatic changes in their accounting methods. This form, also known as the Application for Change in Accounting Method, is filed with the Internal Revenue Service (IRS) and allows taxpayers to request approval for a change in the way they account for income and expenses.

The IRS maintains a list of accounting method changes that are considered “automatic,” meaning they do not require the taxpayer to obtain the consent of the IRS before making the change. This list, which is updated annually, provides specific instructions and requirements for each automatic change and helps taxpayers navigate the process more efficiently.

Using the Form 3115 Automatic Change List can save taxpayers significant time and effort. By following the instructions provided for a specific automatic change, taxpayers can ensure that they meet all the necessary requirements and complete the form accurately. This not only increases the likelihood of the change being approved by the IRS but also helps avoid potential penalties or audit issues related to accounting method changes.

- One example of an automatic change listed on Form 3115 is the change from the cash method to the accrual method of accounting. This change may be required for businesses that exceed certain revenue thresholds or have inventory. By following the instructions and completing the necessary sections of the form, taxpayers can request this change without the need for additional IRS consent.

- Another example of an automatic change is the move from the LIFO (Last-In, First-Out) method to another inventory valuation method. This change may be necessary due to changes in business operations or industry requirements. The Form 3115 Automatic Change List provides taxpayers with the specific instructions and forms needed to make this change automatically.

Form 3115 Filing Instructions

When it comes to tax regulations, it is essential for businesses to stay updated and comply with the necessary forms and instructions. One such form is Form 3115, which is used to request a change in accounting methods for tax purposes. Filing this form correctly is crucial to ensure accurate reporting and compliance with the Internal Revenue Service (IRS).

Before filing Form 3115, it is important to review the Form 3115 Instructions provided by the IRS. These instructions guide businesses through the process of completing and filing the form accurately. They provide detailed explanations and examples to help taxpayers understand the requirements and ensure the proper completion of the form.

The due date for filing Form 3115 depends on the taxpayer’s accounting period. Generally, the form must be filed with the appropriate tax return for the year of the change. However, in some cases, it may be necessary to file the form separately from the tax return. It is crucial to consult the IRS guidelines and instructions to determine the specific due date for filing Form 3115.

Frequently Asked Questions

1. What information is needed for Form 3115?

Form 3115 is used for requesting a change in accounting method and requires information such as the taxpayer’s identifying details, the type and reason for the change, previous and requested accounting methods, tax years involved, financial statements, and a possible user fee payment. Signature and compliance agreement are also necessary.

2. When is the due date for filing Form 3115?

The due date for filing Form 3115 depends on the taxpayer’s tax year. Generally, individuals and most calendar-year partnerships and S corporations must file Form 3115 with their original or amended tax return by the due date of the return, including extensions.

3. What is the Form 3115 Automatic Change List?

Automatic Change List is a list of accounting method changes for which the IRS allows automatic approval, meaning taxpayers don’t need to request consent or file Form 3115. The list includes common changes like depreciation methods, inventory cost flow assumptions, and revenue recognition methods.

4. How do I follow the Form 3115 filing instructions?

To follow the Form 3115 filing instructions, first, review the instructions provided by the IRS along with the form itself. You need to accurately complete all sections of the form, provide supporting documentation, and file it with the appropriate tax return. It’s recommended to consult a tax professional for assistance.

5. Can I file Form 3115 electronically?

Yes, can be filed electronically using the IRS’s e-file system. However, there are certain limitations and specific instructions to follow. Taxpayers should check the IRS guidelines and requirements for electronic filing of Form 3115.

6. Are there any penalties for filing Form 3115 incorrectly?

If form is not filed correctly or if the taxpayer fails to comply with the instructions, penalties may apply. The IRS can disallow the requested accounting method change and may impose accuracy-related penalties or even initiate an audit. It’s crucial to ensure accurate and timely filing in accordance with the instructions.

7. Where can I find additional resources for Form 3115?

The IRS website is the best resource for Form 3115 instructions and related information. Taxpayers can access Form 3115, its instructions, publications, and any updates or changes on the IRS website (irs.gov). Additionally, consulting a tax advisor or professional can provide further guidance and assistance with Form 3115 filings.