EFTPS Login

Are you looking to make online tax payments with ease and security? Look no further than the Electronic Federal Tax Payment System, or EFTPS. In this blog post, we will cover everything you need to know about the EFTPS login process, from creating an account for new users to troubleshooting common login issues. We’ll also discuss why EFTPS is essential for online tax payment and provide tips for ensuring a secure login experience. Whether you’re a business owner or an individual taxpayer, understanding how to navigate the EFTPS login page is crucial for staying compliant with your tax obligations. So, let’s dive in and learn how to make the most out of the EFTPS system.

Why EFTPS is essential for online tax payment

When it comes to making online tax payments, EFTPS (Electronic Federal Tax Payment System) is an essential tool for individuals and businesses alike. This secure and convenient system allows taxpayers to make federal tax payments electronically, ensuring timely and accurate transactions.

One of the key benefits of using EFTPS is the ability to schedule payments in advance, which can help taxpayers avoid missed deadlines and potential penalties. Additionally, the system provides a reliable audit trail for payment history, giving users peace of mind and confidence in their tax obligations.

Another reason why EFTPS is crucial for online tax payment is its integration with other tax reporting systems. By using EFTPS, taxpayers can streamline their tax processes and reduce the likelihood of errors, ultimately saving time and resources.

Overall, the use of EFTPS for online tax payment is essential for ensuring compliance with federal tax regulations, simplifying the payment process, and providing a secure platform for financial transactions.

Creating an EFTPS account for new users

Creating an Electronic Federal Tax Payment System (EFTPS) account is essential for businesses and individuals who need to pay their taxes online. This secure system allows users to make tax payments electronically, saving time and hassle. To create an EFTPS account, new users must first visit the official EFTPS website and click on the Enrollment tab.

Once on the enrollment page, new users will be prompted to provide their Tax Identification Number (TIN), personal information, and banking details. It’s important to double-check all information entered to ensure accuracy. Users will also need to choose a unique Personal Identification Number (PIN) to access their EFTPS account.

After completing the enrollment process, new users will receive a confirmation letter in the mail containing their EFTPS Personal Identification Number (PIN). This PIN is required to access the EFTPS system and make online tax payments. It’s crucial to keep this letter in a safe place and never share the PIN with anyone else.

Once the account is created, users can log in to the EFTPS system using their TIN and PIN. From there, they can schedule tax payments, view payment history, and access other account features. By creating an EFTPS account, new users can take advantage of the convenience and efficiency of online tax payments.

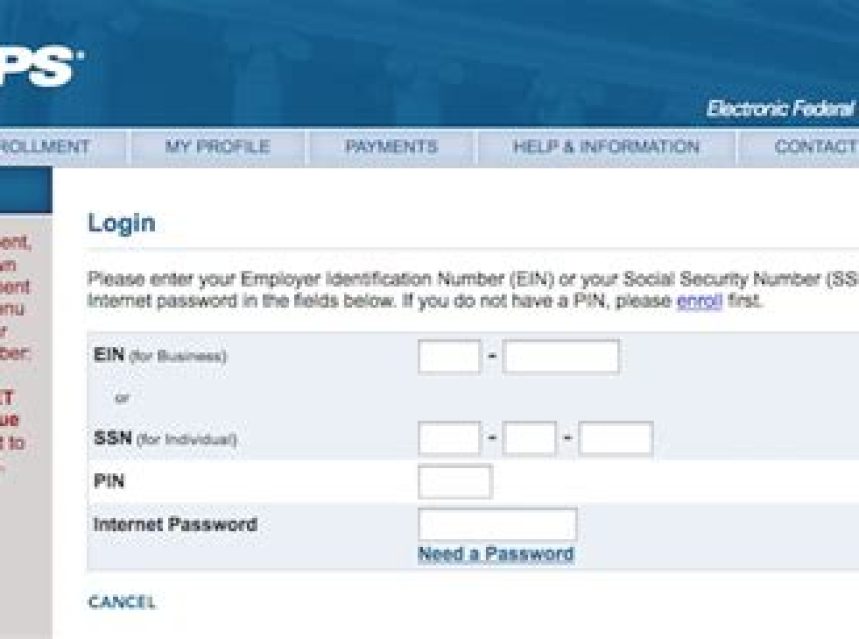

Navigating the EFTPS login page

When it comes to electronic tax payment system (EFTPS), navigating the login page is the first step to accessing your account. To begin, open your internet browser and type in the URL for the EFTPS website. Once on the homepage, locate the login button and click on it to proceed.

After clicking the login button, you will be directed to a new page where you will be prompted to enter your personal identification number (PIN) and your EIN or SSN. Make sure to enter this information carefully to avoid any errors that could prevent you from gaining access to your account.

Once you have entered your PIN and EIN/SSN, click the login button to proceed. If the information you entered is correct, you will be directed to your EFTPS account where you can perform various actions such as making tax payments, viewing payment history, and accessing important tax documents.

If you encounter any issues during the login process, be sure to check that you are using the correct credentials and that your internet connection is stable. If problems persist, you may need to reach out to the EFTPS customer support team for assistance in troubleshooting login issues.

Troubleshooting common EFTPS login issues

Are you having trouble logging into your EFTPS account? You’re not alone. Many users encounter common login issues that can be frustrating to deal with. But don’t worry, there are solutions to these problems that can help you get back into your account and continue making your tax payments on time.

If you find yourself unable to access your EFTPS account, the first thing you should check is your internet connection. A slow or unreliable connection can prevent you from logging in properly. Make sure you have a stable internet connection before attempting to log in again.

Another common issue is forgetting your username or password. If this happens, don’t panic. Simply click on the Forgot Username or Forgot Password link on the login page and follow the instructions to reset your credentials. Just make sure to have your EIN, PIN, and other necessary information on hand.

Additionally, if you are experiencing repeated login failures, it could be due to technical issues with the EFTPS website. In this case, try clearing your browser’s cache and cookies, or using a different browser altogether. If the problem persists, contacting EFTPS customer support for further assistance might be necessary.

Tips for ensuring secure EFTPS login

When using the Electronic Federal Tax Payment System (EFTPS) for paying your taxes online, it is crucial to prioritize the security of your login credentials. With the increasing threat of online fraud and identity theft, taking measures to ensure the security of your EFTPS login is of utmost importance.

First and foremost, it is essential to create a strong and unique password for your EFTPS account. Avoid using easily guessable information such as birthdays or simple words. A combination of letters, numbers, and special characters is highly recommended to enhance the security of your password.

Furthermore, enable two-factor authentication if EFTPS offers this feature. Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

It is also crucial to regularly monitor your EFTPS account for any unauthorized activity. Keep track of your transaction history and immediately report any suspicious or unfamiliar transactions to the EFTPS support team.

Frequently Asked Questions

Why is EFTPS essential for online tax payment?

EFTPS (Electronic Federal Tax Payment System) is essential for online tax payment because it allows individuals and businesses to easily and securely pay their federal taxes electronically. It provides a convenient way to schedule tax payments in advance and eliminates the need for paper checks.

How can new users create an EFTPS account?

New users can create an EFTPS account by visiting the official EFTPS website and clicking on the ‘Enroll’ button. They will need to provide their Taxpayer Identification Number (TIN), personal information, and banking details to complete the enrollment process.

How can users navigate the EFTPS login page?

To navigate the EFTPS login page, users should visit the official EFTPS website and enter their EIN or SSN, EFTPS PIN, and Internet Password. After entering the required information, they can click on the ‘Login’ button to access their EFTPS account.

What are some common EFTPS login issues and how can they be troubleshooted?

Common EFTPS login issues include forgotten EIN/SSN or PIN, Internet Password, and technical difficulties. These issues can be troubleshooted by using the ‘Forgot EIN/SSN’, ‘Forgot PIN’, or ‘Forgot Internet Password’ links on the EFTPS login page. Users can also contact the EFTPS Customer Service for further assistance.

What are some tips for ensuring secure EFTPS login?

To ensure secure EFTPS login, users should never share their EFTPS PIN or Internet Password with anyone. It is also recommended to regularly update their password and enable multi-factor authentication for an added layer of security.